The Deadline Looms

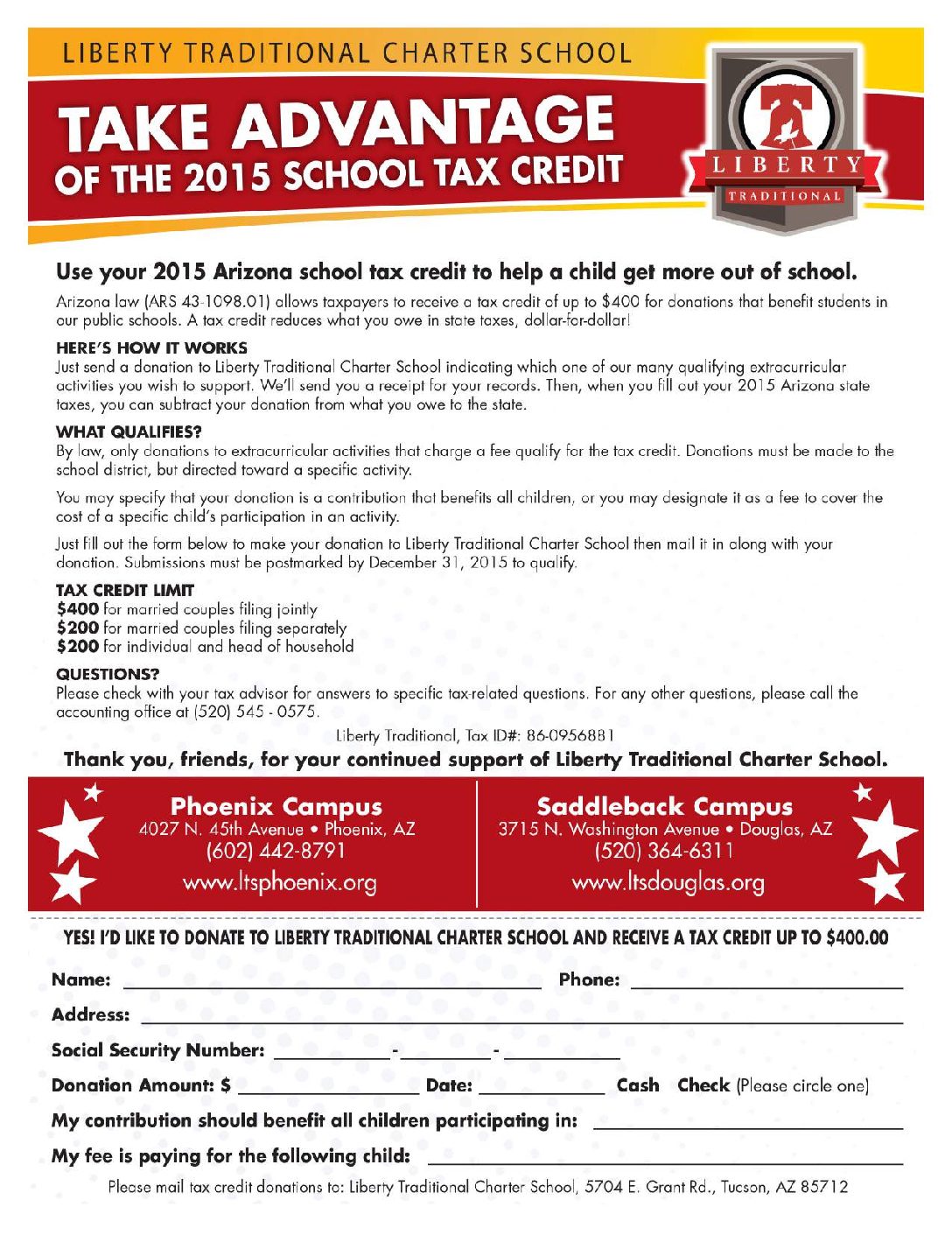

April 15 traditionally closes tax season every year. If you haven’t filed yet, there is still time to earn the 2015 Arizona school tax credit. Arizona law (ARS 43-1098.01) allows tax payers to receive a tax credit of up to $400 for donations that benefit students in public schools. This credit lowers your state tax debt dollar for dollar.

It’s easy as:

- Make a donation to a public school, like Liberty Traditional School.

- Indicate which of our many qualifying extracurricular activities you wish to support.

- Subtract your donation from what you owe the state when you file your taxes.

Things to Keep in Mind

- You must designate your donation towards a particular extracurricular activity.

- Your donation can benefit all children, or you may designate it to support a specific child’s participation in a qualifying activity.

- Extracurricular Activities: clubs, athletics programs, fine arts programs, after-school tutoring, and more.

- The deadline for donation is April 15, 2016.

- Don’t forget the receipt for your donation.

Tax Credit Limits

- $400 for married couples filing jointly

- $200 for married couples filing separately

- $200 for individuals and heads of household

Leave a Reply